retroactive capital gains tax history

The Court reasoned that Congress meant to correct a mistake that afforded an unjustified tax loophole and applied the revision retroactively for a modest period. But prior to such legislative change could be subject to a higher capital gains rate.

Higher Us Capital Gains Tax Proposal Spurs Pe M A Rush S P Global Market Intelligence

President joe biden is formally calling for his proposal for the largest capital gains tax in history to be retroactive.

.png)

. One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9 President Bidens budget proposal suggested raising the rate on such capital gains to 434 percent for households with income over 1 million effective for all. Made permanent the capital gains rate changes in the JGTRRA but provided for a maximum rate of 20 percent. The Administration leaked.

In 1969 during richard nixons administration congress passed the tax reform act of 1969 which raised certain income tax rates with at least twenty retroactive effective dates. Congress has been adopting retroactive tax increases for a very long time essentially since the 1930s. Not only does he want to raise taxes on capital gains to a modern high of 434 he wants to do it retroactively.

Effective for taxable years beginning after 31 December 2012 ie. If you live in a state that taxes capital gains youre going to see an additional tax on top of it leaving certain individuals with marginal capital gains rates past 40. President and Congress hold the power to raise taxes retroactively meaning that the increase could apply anytime during that same calendar year.

And 2 the period of retroactivity is not excessive. In different words the 1031 exchange merely places off paying capital gains taxes till sellers hold onto the proceeds from a house sale. Those changes usually involve rate decreases however which are typically easier.

Indeed we need not look back too far in history to find a prime example of retroactive tax increases. Explanation of the Constitution - from the Congressional Research Service. In 1969 during Richard Nixons administration Congress passed the Tax Reform Act of 1969 which raised certain income tax rates with at least twenty retroactive effective dates.

The 20 tax rate on capital gains can raise as high as 318 for some individuals. A historical review suggests that any tax legislation enacted in 2021 could have retroactive effect to transactions. This paper presents a new approach to the taxation of capital gains that eliminates the deferral advantage present under current realization-based systems along with the lock-in effect and tax arbitrage possibilities associated with this deferral advantage.

President Biden really is a class warrior. Completed at any time in 2021. Issue Date December 1988.

Retroactive tax provisions in 1969 1987 and 1993 withstood constitutional challenges in part because they were designed to create more taxpayer equity and to eliminate loopholes. Legally the US. The higher the rate the less likely taxpayers will sell assets and be subject to the tax.

One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9 President Bidens budget proposal suggested raising the rate on such capital gains to 434 percent for households with income over 1 million effective for all sales on or after April 2021. The 1913 Revenue Act was the first one with an effective date before the date of the actual. The 20 tax rate on capital gains can raise as high as 318 for some individuals.

Thats just the federal rate. If the capital-gains rate is increased millionaire and billionaire taxpayers would actually face a 434 tax on capital asset sales when factoring in a 38 tax linked to the Affordable Care Act. The test upholds retroactive tax application if.

The new approach also taxes capital gains only upon realization but by effectively charging. In recent years such retroactive rate changes have occurred as late into the year. In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987.

The 1031 Exchange named after Section 1031 of the IRS tax code permits investors to place off paying capital gains taxes in the event that they reinvest the proceeds made from promoting a rental property into another funding. In 1969 during richard nixons administration congress passed the tax reform act of 1969 which raised certain income tax rates with at least twenty retroactive effective dates. For tax 12 months 2019 no capital gains tax is owed if taxable revenue is beneath 39375 for single filers seventy eight750 for joint filers.

This resulted in a 60 increase in the capital. The National Law Review points out that in recent years retroactive tax changes have occurred as late in the year as August. The following state regulations pages link to this page.

There is pressure for another wealth tax on individuals making 5 million or more who would see another 3 tax raise. This resulted in a 60 increase in the capital gains tax collected in 1986. More specifically in August of 1993 Congress passed the Omnibus Budget Reconciliation Act.

7 rows signed 7 june 2001. The American Families Plans proposed tax rate of 434 on capital gains is the highest tax rate on long-term capital gains in the past 100 years and the largest increase in the long-term capital gains rate in US. While the most significant recent capital gains rate change provided by the JGTRRA was largely.

Signed 2 January 2013. 1 the legislation has a rational legislative purpose and is not arbitrary.

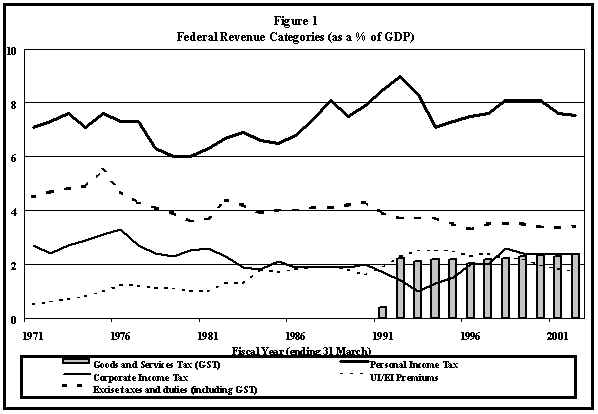

Federal Revenues Changing Trends And The Quest For Tax Reform 90 3e

Wall Street On Tax Plan It Will Incentivize Selling This Year Bloomberg

Managing Tax Rate Uncertainty Russell Investments

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

The Feds May Move To Hike Capital Gains Tax A Bad Idea Renx Real Estate News Exchange

Good And Bad News From The Aba Futures Report Perspective Decade Century Aba Bad News

Managing Tax Rate Uncertainty Russell Investments

The Economic Impact Of Tax Changes 1920 1939 Cato Institute

The Capital Gains Tax Rate Talked About A Lot But No Change Yet Welch Llp

Cryptocurrency Tax War Part Ii

Carrying Capital Losses Backward Or Forward 2022 Turbotax Canada Tips

The Economic Impact Of Tax Changes 1920 1939 Cato Institute

How To Help Your Real Estate Investor Clients Structure Their Businesses Accounting Today In 2021 Real Estate Investor Real Estate Investors

The Capital Gains Tax Rate Talked About A Lot But No Change Yet Welch Llp

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra

Archived Tax Planning Using Private Corporations Canada Ca

Biden Banks On 3 6 Trillion Tax Hike On The Rich And Corporations The New York Times